The UK Revenue and Customs service introduced new regulations in 2019 for the submission of quarterly VAT returns. Returns must be uploaded via Making Tax Digital (MTD) approved software which links to the company’s business management software.

Trade Control is currently developing a free interface to the HMRC MTD service.

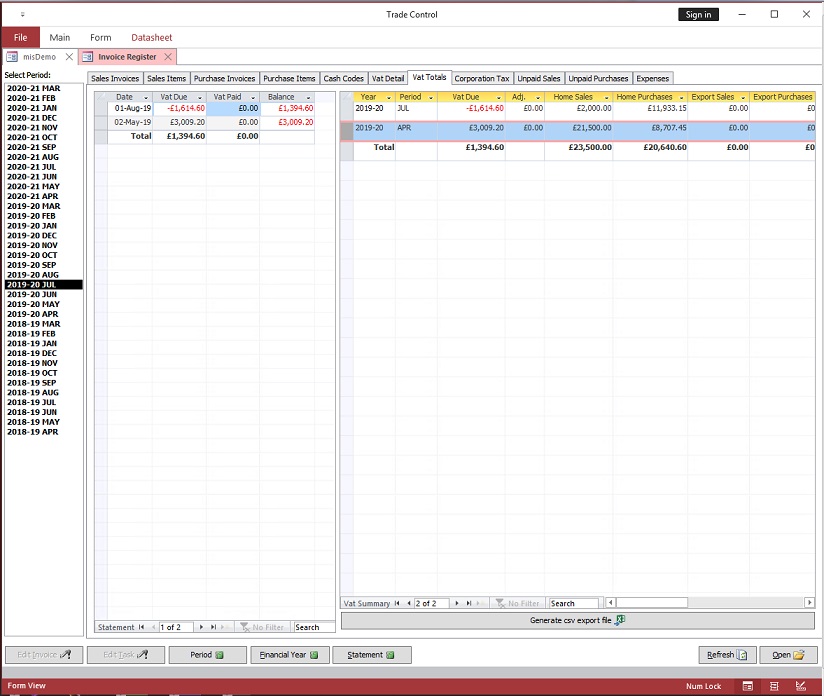

In the meantime, you can utilise a relatively inexpensive and simple solution to allow VAT returns to be uploaded to a third party MTD approved service via a .csv file which is generated in the Invoice Register. All of the data required for the VAT return is stored in Invoice Register/Vat Totals and a .csv file is generated by selecting the Period in Vat Totals and clicking on “generate csv export file” below the Totals.

The installer gives the client the ability to output the vat return in the required format.

UK MTD installer - tcOfficeMTD.zip

(refer to the services tutorial for how to open the Invoice Register)

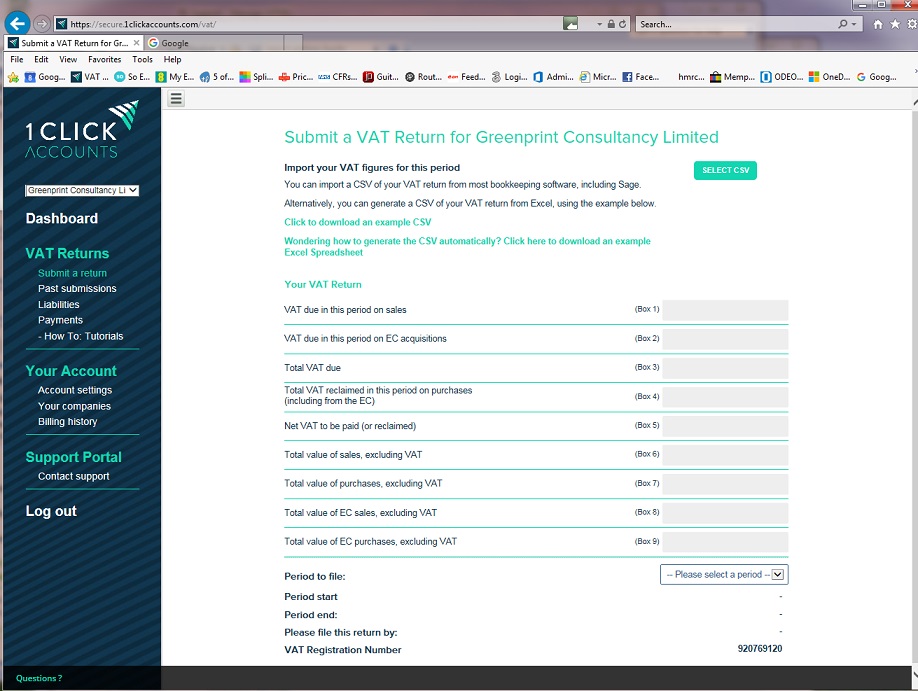

The .csv file should be saved to a suitable folder to enable it to be selected when submitting the return to HMRC via the third party software. The software can be purchased from 1 Click Accounts (www.1clickaccounts.com) and the cost at time of writing (July 2019) was GBP 9.95 per annum.

Simply log into the website and click the “SELECT CSV” button to upload the relevant quarterly return.

This method of uploading VAT returns to the MTD service is simple and inexpensive and complies with the 2019 HMRC requirements.